Accounting Settings

Workflows > Endpoints > Client Settings > Accounting Settings

Purpose: Retrieve details of the client accounting settings. Retrieve, create or update general ledger accounts.

These workflows are typically used in cases where the accounting settings information is needed in order to post transactions to Go. It might also be relevant to retrieve the settings to supplement information in reporting workflows.

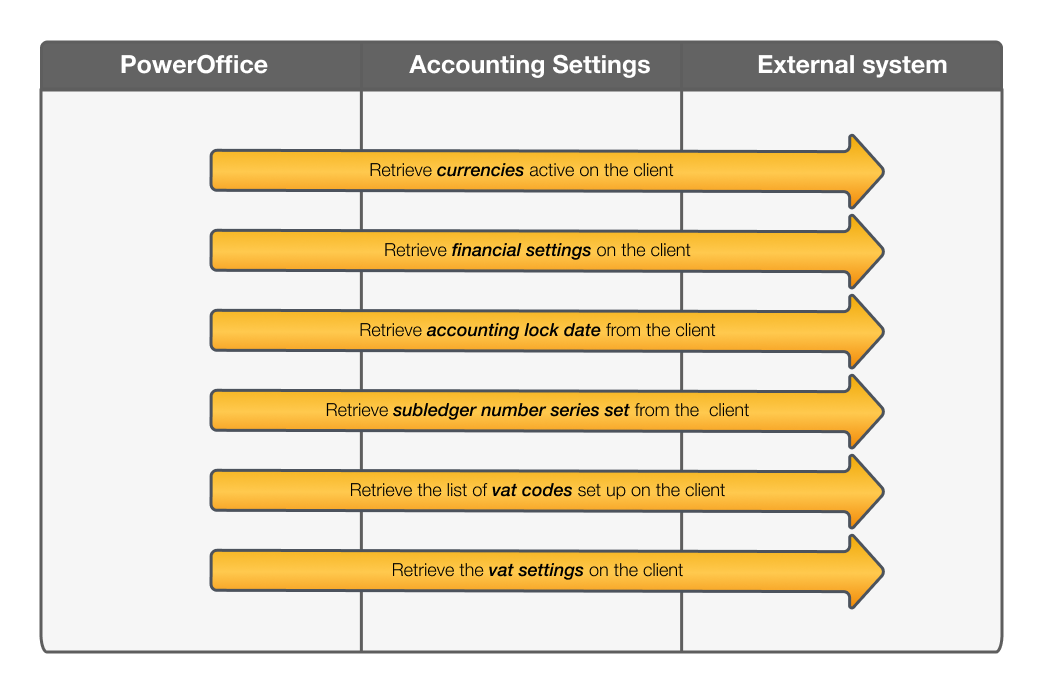

Description of the workflows:

Retrieve general accounting settings:

Retreive currencies set up for use:

Retreive the currencies active on the client. The currencies in active use on the client can be used in GUI operations in Go, but does not affect which currencies that can be used when posting transactions using the various endpoints for posting transactions.

Retrieve currency rates:

Retreive the currency rate for a currency pair, if needed in voucher workflows. The currency rates in Go are retrieved from the European Central Bank's currency api on a daily basis, and the rates will be updatet each day around 16:00 CET.

Retreive the financial settings set on the client:

Retreive financial settings from the client. This includes the convertion date (ie the date the client startet using Go for the accounting), as well as information of currency gain/loss accounts and financial year.

Retreive the lock date settings on the client:

Retreive the accounting lock date from the client. The lock date define which accounting periods that are locked. Transactions cannot be posted with dates dating back before the current lock date.

Retreive the subledger number series defined on the client:

Retreive the subledger number series set from the client. The subledger number series define the series of customer numbers, supplier numbers and employee numbers that can be used on the client. The series also define the connected general ledger account.

Example and special note: The standard setup in Go, is that the customer series range from 10 000 - 19 999, and is connected to the general ledger account 1500. No transactions can be posted directly to a general ledger account set up as a subledger, ie transactions cannot be set with the account 1500. Subledger transactions must be posted via the subledger - in this example the customer account number (ie the customer number).

Retreive the vat codes used on the client:

Retreive and list the vat codes set up on the client. Go uses standard SAF-T vat codes, but the client have the option of creating custom codes (based on SAF-T codes) if they need codes that split vat and vat free handling.

Retreive the vat settings on the client:

Retreive the vat settings on the client. This includes infromation of vat reporting type and periods, vat number and general vat reporting settings.

.png)

Synchronize general ledger accounts:

Synchronize to Go:

Check whether the general ledger account already exists in Go

Create or update information

Synchronize from Go

Check if there are any new or updated accounts in Go

Retreive any new information

Prerequisites

Access to the CommonServices access privelige

The client need at least one active subscription of a PowerOffice Go module

Access to the GeneralLedgerAccount access privelige

The client need one active subscription of an accounting module of PowerOffice Go

Related workflows:

Posting vouchers to Go

Reporting transactions from Go

Creating contact objects (customers, suppliers, employees)

Creating dimension objects (project, location, dim1-3 etc)

Dictionary/Terminology:

General ledger account: In accounting terms, this is an ordinary account used in the general ledger of the accounting system

Subledger: A subset of a general ledger account, containing spesifications of the transactions for either customers, suppliers or employees. In PowerOffice Go, a general ledger acccount that have a subledger, require the use of the subledger account number (ie the customer/supplier/employee number) when transactions are posted.