eCommerce

Workflows > Usecase > eCommerce, POS and payments > eCommerce

Use case: Integrating an eCommerce solution with PowerOffice to handle invoice production and SAF-T sales reporting, determining whether webshops can produce compliant invoices and sales reports, and managing payment events and methods through dedicated asset accounts.

This article discusses the necessary considerations and distinctions for integrating eCommerce or webshop solutions with PowerOffice, focusing on how webshops handle invoice production and SAF-T sales reporting, and detailing different integration approaches based on these capabilities.

Important supplementary information:

Integrating eCommerce with PowerOffice: Invoice Compliance Essentials

ECommerce or webshop solutions need to make some important clarifications before integrating with PowerOffice, as described in the important supplementary information articles linked at the start of this article. In general, one can safely assume that any webshop sale follow the documentation rules of invoices. The question then becomes one of two important distinctions:

Can the webshop produce and send (to the end customer) invoice documentation that satisfy the current accounting legislations and requirement for the seller (the client), or

Will the client need to use PowerOffice to produce invoices?

Webshop produce and send invoices (to end customer)

This poses another important question to determine the integration approach: Can the webshop produce the required SAF-T sales reporting?

If yes: The sales can theoretically be aggregated and transferred in a batch to PowerOffice, using either BankJournal, CashJournal or ManualJournal voucher type. If so, the properties <SaftBatchId> and <SaftSourceId> must be provided to include an audit trail between the SAF-T reporting from PowerOffice with the SAF-T reporting from the webshop system. If this is not feasible, the sales should be transferred as described in the point below - which might be more practical in any case.

If no: Each distinct sale with customer and invoice information should be transferred to PowerOffice using the Customer and OutgoingInvoiceJournal endpoints. With the current legislation, gross amount per account per vat code is sufficient, but this might be subject of change in future implementations of SAF-T requirements. The case may also involve transferring payment events as described below.

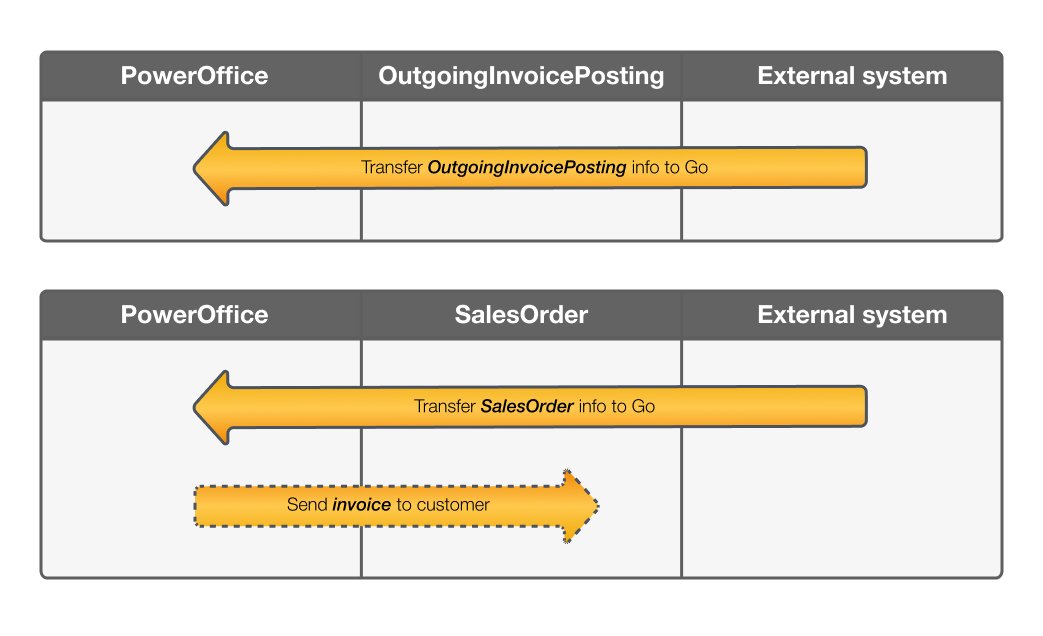

Invoices need to be created and sent from PowerOffice

In this approach the workflow is to transfer sales orders, create and send invoices and optionally handle different payment events. The core workflow is sales orders and creating and sending invoices are described in this article.